Effective Financial Risk Management Strategies

Financial risk management is crucial to business success and requires a clear understanding of the key strategies to protect assets and ensure a sound financial future. In this article we present some of the keys.

Tabla de contenidos

ToggleHow to protect finances and assets with proven financial risk management strategies.

A company may have the best tools, sell the best product or have the most qualified employees, but if its financial component is not healthy, its growth prospects are significantly reduced. Even if the financial side is healthy, organizations are exposed to various financial risks ranging from market volatility to economic fluctuations.

For this reason, it is important that companies have the capacity to perform different financial risk analyses to anticipate and ensure business resilience to circumstances that may arise, protect assets and ensure that their financial future is robust.

Financial risk management strategies

There are different approaches to financial risk management. One of the risk management strategies is Value at Risk (VaR), which quantifies the potential risk of loss in an investment portfolio over a specific time interval. By using statistical methods and mathematical models, VaR provides an assessment of financial risks and allows investors, through financial risk models, to anticipate and manage risks effectively.

In a Finance 5.0 environment, another important perspective in financial risk management is the so-called sensitivity analysis. This approach involves assessing how changes in key variables can affect results and profitability. It is one of the most widely used strategies in financial risk mitigation and is commonly used in investment portfolio management as it anticipates changes in interest rates or foresees changes in economic conditions that may affect asset performance, allowing organizations to carry out an accurate and timely analysis of their portfolio. portfolio diversification.

Risk management tools

There are different risk management tools on the market that allow you to execute different strategies, check regulatory compliance in finance or assess credit risk, among others. The Smart CG by aggity solution allows the implementation of modern and updated financial management systems to streamline the control of the company’s economy, while facilitating its organization. Among other functions, the solution allows to establish a control of the company’s fixed assets, as well as of all important data for the integral management of the organization.

Main risks

There are different types of risks faced by companies. Among the most important are the risks in financial markets, which are caused by volatility and fluctuations in the prices of financial assets. Normally this type of risk, associated with investment risks, occurs because market conditions change abruptly due to economic, political or social events. Typically this scenario affects stock, bond, currency and commodity prices.

Financial risks in the banking industry

Another risk is that affecting the financial or banking sector. There are several risks that affect this sector, such as risks due to changes in interest rates, which may affect the value of financial assets and liabilities. Credit risk is directly associated with the variation of interest rates and may cause debtors to stop paying their debts in the event of a rise in interest rates.

Another important risk associated with banking is that of liquidity. We have seen it earlier this year with the crisis of several US regional banks and it occurs when a bank is unable to meet its financial obligations due to a lack of cash or liquid assets. The management of this risk involves ensuring that sufficient resources are available to cover liabilities and to avoid the forced sale of assets.

Financial risks in digital transformation

The vast majority of companies are immersed in digital transformation projects and this entails different financial risks that should be approached with caution and considered in cybersecurity audits.

The main risk is related to financial cybersecurity. The introduction of different technologies and the digitalization of processes increases security breaches and the possibility of suffering a cyber-attack. As a result, the protection of data and systems becomes a matter of concern and increased investment in improving security measures is required.

Últimos posts

aggity strengthens its commitment to sustainability as a SILVER partner of “Fundación Empresa & Clima”.

aggity participates in the IBM Ecosystem Summit 2024 with an applied case of Generative AI in the food industry

Aggity, together with the multinational Fortinet, present an exclusive event in Lima on the application of Generative AI in Corporate Cybersecurity.

aggity participates in Smart Ports: Piers of the Future

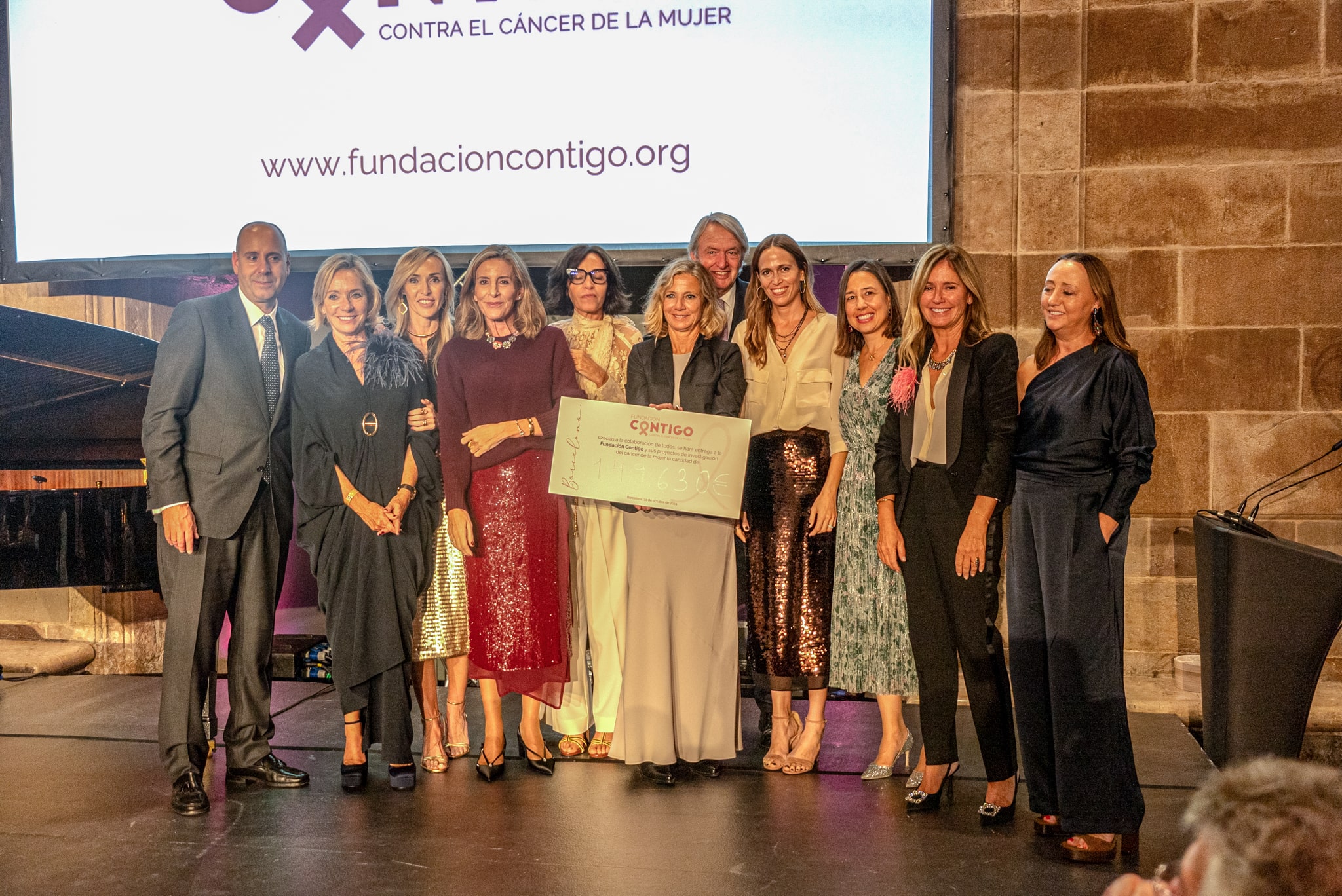

aggity Supports the Contigo Foundation at its Annual Dinner

Challenges and Opportunities of Generative AI in Industry: Our Experience at BNEW

Official Liferay Partner in Spain